A Recap: New York FinTech Week

Uncertainty = Opportunity

After spending the week in New York City for FinTech Week, one of the only things clear from the participants is the lack of clarity on the direction of the economy, capital raising and investing. But what is also clear is that there are many great entrepreneurs wanting to make financial services better through automation and cooperation.

By cooperation, we mean that the best ideas start with finding ways to get competitors to work together to solve industry problems. It might be as simple as a platform for sharing information. Or perhaps a place to resolve differences in an automated fashion. Or it might be helping the entrepreneur by providing insights and contacts in the industry or process they are trying to improve.

For automation, there was a lot of buzz around AI. It's not surprising that fast-moving business people focus on innovative ways to use new technology to improve all aspects of their targeted markets. This is true not only for the entrepreneurs we met but also for those leading innovation at insurance companies, banks, asset managers and tech companies. With all the uncertainty floating around, it feels like a certainty that the wave stemming from the newest versions of AI/ ML will change the world.

To get a sense of how fast this will impact in our economy, just look at this chart by Kyle Hailey (@kylelf_), which is so effective in showing the adoption curve of various consumer technologies. Think about the fast pace at which streaming movies and music changed their industries. Now compare that to AI coming to your business at the pace seen with ChatGPT!

We have focused on AI as an impact technology since we started the firm so we feel well-positioned to help startups be part of this acceleration. FinTech Week reinforced the inflection point that is now upon us and we are certain it will be filled with great companies to back.

-Mark & Dave

New Portfolio Company

Cork is a cyber warranty/ insurance platform for MSPs serving small businesses designed to fix the fast-growing, persistently broken cyber risk market. With a complete, data-driven warranty solution that is backed by risk monitoring and detection, Cork's inside-out approach to cyber risk helps MSPs democratize cyber protection. Find the full press release here!

Envisions Interview

A Recap: New York FinTech Week

w/ Mike Nugent, Managing Director at Vestigo Ventures

Observations from Red Sox Fans in Yankee Land

While we love going to New York City, we have to admit it's tougher to do when our sports teams are not up to par. Like the current economy, this too will pass.

- We saw fewer entrepreneurs than past years at the events. Clearly, there is more incentive to remain fully employed with large employers when facing uncertainty in the economic landscape.

- We have not yet seen the blockchain crowd move towards more traditional Fintech. They will come - they are too talented to avoid the move.

- There was lots of desire from VCs to do deals but with a marked willingness to wait until the proverbial "blood is in the water", as often heard from late-stage investors. Yet the willingness to wait on deals does not diminish the need for work to be done now. It feels like the situation will get better in another 6-9 months, and only the rigorous will be ready to capitalize.

- Based on conversations with VC friends, B2C is DOA. The lessons of strong incumbent brands, regulatory moats and the simple fact that scale matters have now been relearned in FinTech venture investing. We were always skeptical, but now the rest of the industry is joining our point of view.

- Changing investment approaches and targeting other stages was a popular discussion among the investor class. If they were growth, they are moving down the cap stack. If they were A or B investors, they want to move to seed. Moving targets is often difficult, as deal sourcing is very different at the early stage.

Despite these experiences, we still came away excited by the possibilities and realistic about what it takes for an early-stage startup to succeed. Seeing the market return to a realistic understanding of the risks involved creates opportunity for disciplined investors.

- Team Vestigo

New York FinTech Week

Mass FinTech Hub Student Boot Camp

Spotlight on Angel Investing

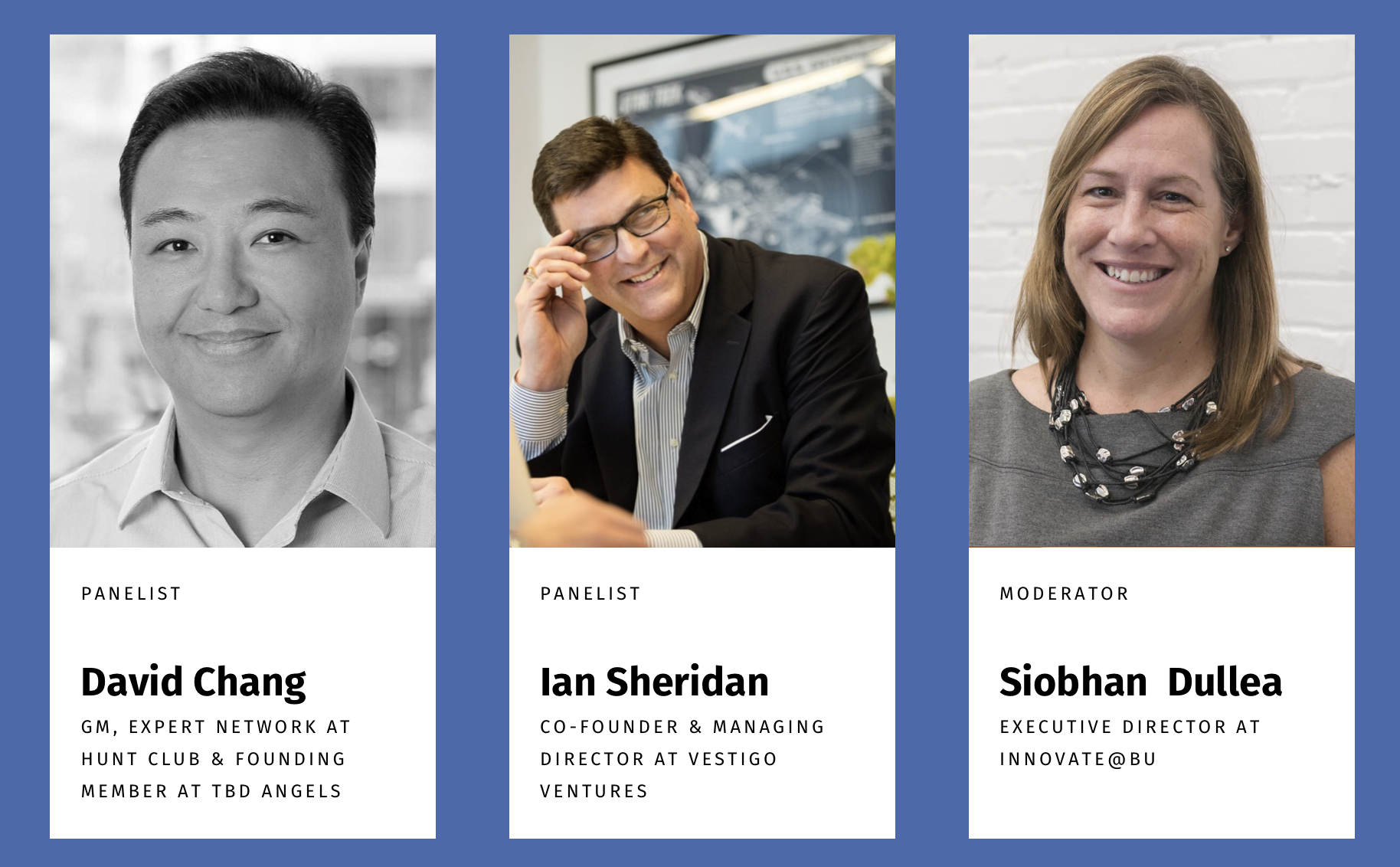

Don't miss this event highlighting the importance of angel investing in the startup community with an expert panel featuring our very own Ian Sheridan and David Chang, Founding Member at TBD Angels. Register here!

Portfolio Updates

SaaSWorks Now Monitoring $1.5 Billion in Revenue

The SaaSWorks team keeps on impressing, building a product that is a CFO's dream and whose indispensability continues to speak for itself!

Jobble's Medical Insurance Is Now Live

We're excited to announce that Jobble has now set up a platform for Jobblers to find health coverage!

Climate Club Listed Among On Deck's Top Companies of 2023

The accelerator highlights its best performers through a wide range of factors, including funding, valuation, momentum and the importance of the issue they are solving.

.webp)

Interesting Reads

Apply to One of Our Portfolio Companies!

Our mailing address is:

Vestigo Ventures

1 Kendall Sq Ste B2101

Cambridge, MA 02139-1588

Add us to your address book

DISCLAIMER: The information presented in this newsletter is intended for general informational purposes only and may not reflect current law or regulations in your jurisdiction. By reading our newsletter, you understand that no information contained herein should be construed as legal, financial, or tax advice from the authors or contributors, nor is it intended to be a substitute for such counsel on any subject matter. No reader of this newsletter should act or refrain from acting based on any information included in, or accessible through, this newsletter without seeking appropriate professional advice on the specific facts and circumstances at issue from a professional licensed in the reader's state, country, or other appropriate licensing jurisdiction. This newsletter and its content should not be considered a solicitation for investment in any way.