A Recap: World Economic Forum

On the Road

Dave along with Ian hit the road to Davos this month. Read more about their insights from this amazing gathering in the updates below. While there is a glamorous side of global leaders, the key to a great Davos experience is to dig in with the latest thinking on technologies and innovation.

We are also hitting the road to see the portfolio companies and prospective investments. You learn so much when you can sit with the leaders of companies and discuss their vision and struggles and opportunities. We had recent trips to San Francisco and to NYC. While we see plenty of deal flow from our offices in Cambridge and via XPLR, our algo deal seeking machine, we need to be out to share stories and learn.

—Mark & Dave

World Economic Forum 2019

Introduction

w/ John Werner & Sandy Pentland

Davos

This year, I had the opportunity to attend the World Economic Forum (WEF) at Davos. Founded in 1971 as a not-for-profit foundation, the WEF recognizes that the world is changing at an ever increasing pace. The forum brings together leaders from across many spectrums of society: politics, business, academia, NGOs, and the arts, who travel from all parts of the globe to discuss the biggest challenges facing the world. The topics of this year’s conference ranged from Big Data, Blockchain Technologies, Artificial Intelligence to Social Inclusion and Equal Opportunity.

“The Forum strives in all its efforts to demonstrate entrepreneurship in the global public interest while upholding the highest standards of governance. Moral and intellectual integrity is at the heart of everything it does.”

-WEF

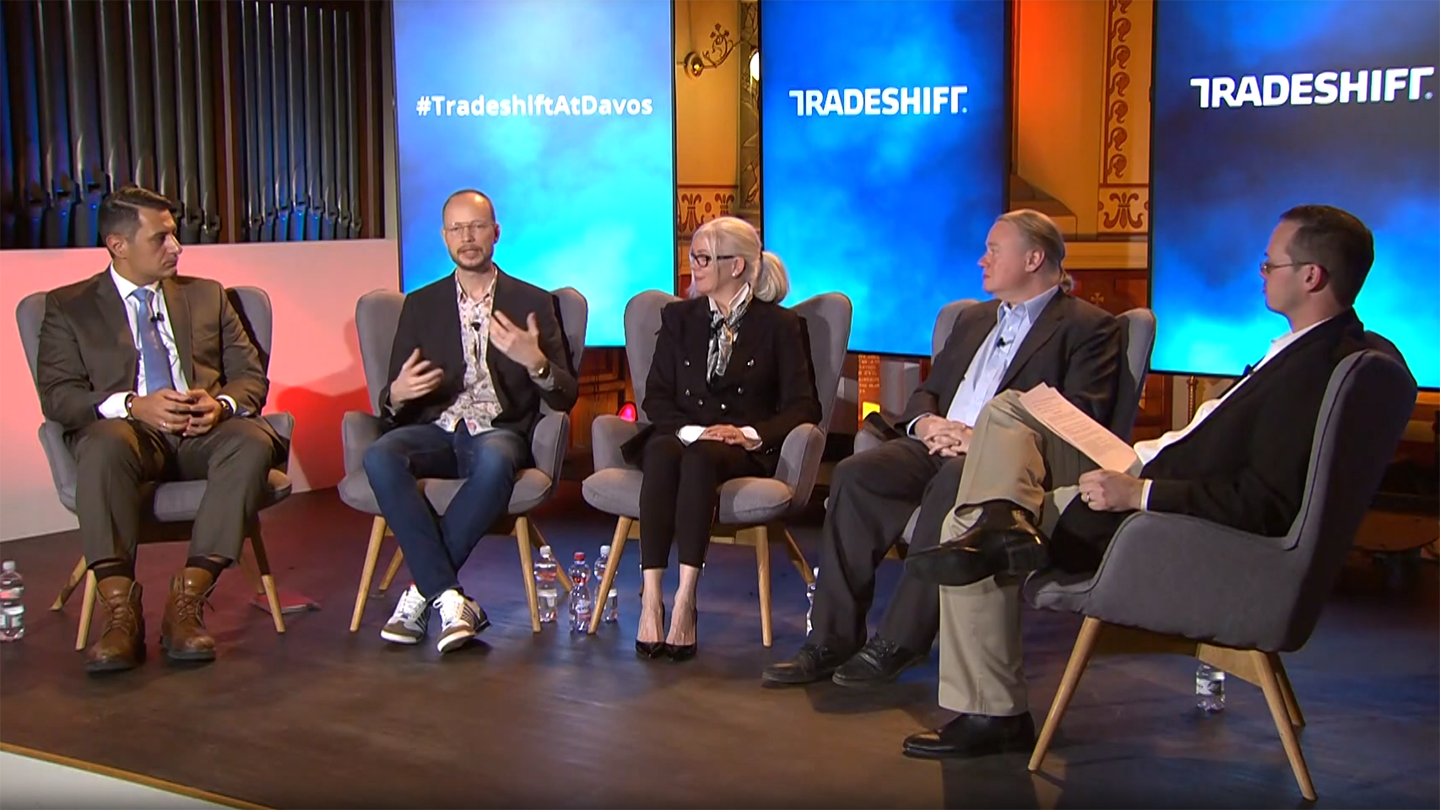

Invited by John Werner of our Advisory Board, Vestigo was given the unique opportunity to participate and present. Our General Partner David Blundin, Vestigo advisor and Cogo Labs CEO Mira Wilczek, and FRST (a Vestigo Portfolio Company) CEO Karl Muth each presented. Mira and Dave shared thought provoking perspectives on Big Data. Karl Muth articulated the evolution of the Crypto marketplace while demonstrating the visualization power of the FRST platform.

David’s presentation described his journey as an entrepreneur and his ability to link the power and ubiquity of Big Data. He conveyed to the audience how the simultaneous evolution of software, processing power, growing data sets, and Blockchain Technologies will enable entrepreneurs to quickly move their companies and careers forward.

Mira was able to set the stage for Big Data in a trustless world and the important role that Blockchain Technologies will play. It was a thought provoking talk as Mira shared the IDC estimate that the average human on earth will generate 1.7MB of digital data every minute, while comparing the “wet” data (eyes, and ears) generated by the humans in the room at Davos. She discussed the challenges of data ownership, transparency, replication, and security, affirming the role of Blockchain Technologies.

Karl took us on a journey through the crypto world from the revolutionist to the professional. He described why FRST was created and demonstrated the power of their trading tools. The audience was amazed by the magnitude of the visualization tools and the edge that the platform provides for professional organizations trading crypto currencies. Karl outlined the path that we are moving along: from the crypto winter to the professionalization of the marketplace.

At Vestigo, we leverage Big Data and machine learning every day to find great FinTech companies. The collective “wow” moment from these talks, was the tangible absorption of the transformative power of Big data by the Davos audience. The results of the talks where immediate. Dave was quickly whisked away by the executive leadership from TATA, Forbes and many others. Mira was recruited to a leadership panel with the CIO of the US Government, Karl was interviewed on TV. I was engaged in the debriefs discussing Vestigo and our unique portfolio of financial services solutions with leaders from the world's largest financial intuitions.

There were many wonderful random collisions of ideas and meet-ups with people from all sectors of society. I met a physicist who is developing the next generation of quantum computers. Over lunch he was able to explain how quantum computers work and for a moment I think I understood him. We attended an incredible variety of events including, the day at the TATA/MIT TCS Dome, CSAIL Artificial Intelligence group discussion, The TCS Global Reception, NYTimes Debate, Aberdeen Investments scotch tasting party, the Harvard networking event, the Global Blockchain Business Council dinner, the evening with Forbes executives, and had the opportunity to meet many thought leaders like Steve Forbes and David Rubenstein, the co-founder and co-executive chairman of The Carlyle Group, Tim Berners-Lee (inventor of the Web) and Amy Cuddy Ph.D. (most viral Ted Talk) and so many more amazing people.

We made many new connections and look forward to future engagement and visits to Cambridge. These are seeds that may well translate into good business, time and effort will tell. I want to thank John and our General Partners, Dave and Mark who created a unique opportunity for Vestigo along with Karl from FRST. We are looking forward to being invited back next year and we hope to include one or two of our leading portfolio companies.

The trip was a huge success. Being part of the collaboration of ideas through intellectual exchanges and having exposure to people willing to challenge the status quo was a whirlwind of fun!

—Ian Sheridan, Co-Founder & Managing Director

A Funny Thing Happened on the Way to the WEF

In a wonderful article by Vestigo advisory board member John Werner and long-time collaborator Sandy Pentland (#geniusvisionary) we hear about the minds that truly shone in Davos this year.

New Portfolio Companies

Cushion

XPLR scores again. Our second investment that resulted from identification of potential viral companies in our Cogo Labs data is now complete. Cushion joins our portfolio companies as a personal finance application that automates stressful, complex and tedious actions to reclaim or save money for their customers.

They are targeting bank fees which total over $200B annually on consumers. They negotiate via an automated process with the banks to get these fees reduced or eliminated. They have saved customers hundreds of thousands of dollars while in Beta.

Paul Kesserwani is the founder and CEO along with Ivan Balepin as CTO and Lauralynn Stubler, in charge of growth and retention, run the firm. It is a lean team that has built an impressive technology on a shoestring. We applaud their lean style of management.

Alloy

We met Tommy Nicholas, founder of Alloy, in our search for a technology first approach to the insufficiencies in today's AML/KYC solutions. We were immediately impressed with their approach to on-boarding new clients for banks and FinTech startups. This is critical in their role to provide proper KYC and AML compliance systems as well as to protect themselves from fraud.

Tommy is joined by a great team. Laura Spiekerman is their CRO along with Edwina Johnson, COO, have great startup experience that will help the company with the inevitable twists and turns. Charles Hearn is the CTO providing the early build along with client success on-boarding. Sue Devine, VP Customer Success, trains the clients in using their capabilities.

Alloy’s use results in 98% automation of customer acceptance decisions with a 50% reduction in fraud. Further it reduces the need for manual review by 95% which is an enormous savings for those firms using their solutions. Helping firms reduce costs while providing better regulatory outcomes is why we are pleased to be able to join their recent fund raise in a convertible note.

Interesting Reads

Apply to One of Our Portfolio Companies!

Our mailing address is:

Vestigo Ventures

1 Kendall Sq Ste B2101

Cambridge, MA 02139-1588

Add us to your address book

DISCLAIMER: The information presented in this newsletter is intended for general informational purposes only and may not reflect current law or regulations in your jurisdiction. By reading our newsletter, you understand that no information contained herein should be construed as legal, financial, or tax advice from the authors or contributors, nor is it intended to be a substitute for such counsel on any subject matter. No reader of this newsletter should act or refrain from acting based on any information included in, or accessible through, this newsletter without seeking appropriate professional advice on the specific facts and circumstances at issue from a professional licensed in the reader's state, country, or other appropriate licensing jurisdiction. This newsletter and its content should not be considered a solicitation for investment in any way.