All Weather Prep

Withstanding the Storm

The wind is howling, and it seems rather bleak from the window of high-growth companies. As we exit a period of very frothy markets with rapid increases in interest rates we are not surprised to see the tremendous downdrafts in valuation in the past several months.

However, all is not lost as this is a typical revaluation at this stage of high inflation and a lower economic growth cycle. As venture investors, we invest in the earliest stages of companies, where on average we will hold these companies for nine years in our portfolio. Therefore, we must make sure they can survive this cycle. For example, we must take into account their target buyers and how they react in slowdowns, to determining how capital efficient the business is.

We share our insights on what they need to do in the near term to be careful. In the end, our style of investing at good values with a target of quickly creating a business model that will produce profits is shown as superior in these moments.

We also say it all feels more comfortable with a correction. Valuations and expectations were out of balance until recently. A good pullback puts the fundamentals in perspective.

— Mark & Dave

New Portfolio Company

We are delighted to announce our latest investment in SaaSWorks, the subscription analytics monitoring and actionable-insights nudging platform and service for recurring revenue businesses. Owners and operators, finance leaders, and revenue operations teams turn to SaaSWorks to monitor and grow their SaaS, FinTech, and Health & Wellness businesses.

Founded by Vipul Shah (ArrowMark Partners, Goldman Sachs, co-founder Pyramid) and Jim O’Neill (founding CTO, HubSpot, SunGard, Pyramid), SaaSWorks brings together a unique combination of SaaS operational success and “investor-brains”. We’ve had the pleasure of getting to know the founders well over the past three years and couldn’t be more excited to cement our partnership with an investment.

Portfolio Company Spotlight

In this month's newsletter, we are excited to shout out Acquire; a company focused on reimagining the checkout process by creating branded and enhanced checkout pages without the need for code.

Currently, Acquire is looking to partner with merchants running on Shopify or Shopify plus that are doing $2M+ in GMV per year. If you, our readers, know of any merchants, please feel free to send them our way! Additionally, if you wanted to learn more, please check out their website and discover the wide range of use-cases from email, text, or retargeting. If any of these use-cases look interesting to you, please book a demo with the Acquire team!

Vestigo Ventures is Hiring!

We are excited to announce that the Vestigo is looking to expand our team! We are currently seeking to hire a data analyst to help manage our data assets and drive portfolio insights through the use of data.

If our readers know anyone, or if you are looking to join an early-stage FinTech VC, please apply here, and we will get back to you as soon as possible.

In this episode, Frazer speaks with the General Partner of Portage Ventures, Steph Choo, where they discuss her path into FinTech and how she views the ever-changing world of FinTech.

Things to Consider When Facing External Economic Forces

As operators turned investors, we are always seeking out ways to lend a helping hand, and “lean in” to support the great founders we have partnered with. Over the past few months, we have seen tremendous external forces changing the outlook on the economy and wanted to gather our team’s best thoughts/tips to share with our founders. Below are the top five areas of focus from the Vestigo operators' lens that came out of our discussions and we hope our readers benefit from these thoughts.

Morale (building/maintaining a culture)

- Keep morale high through transparent communication and clear vision while using this opportunity to pick up talent when others are struggling.

- Cultures become galvanized when the strategy and go to market plan are clear, concise, and cogent

Expenses

- Do not overspend, watch cash burn and make improvements as needed to ensure sufficient runway (growth with your eye on profitability)

- Know your net operating cost and cash flow, measure and understand your customer ROI to reduce churn and drive growth

Incentives

- Confirm that teams are strategically and economically aligned

- What the business decides to incent, drives the results

Execution focus

- Multiple strategic projects lead to multiple success, keep it measurable and manageable

- Focus and know all the operating levers in your business model, focus on what you can control and work each one to optimize, e.g., can you sell more to existing customers, can you increase price? Can you improve retention?

Sales is the great elixir

- Inform, equip, and excite your prospects on how easy it is to make a smart decision to do business with you

- Know your customers, remind them at every opportunity they made a smart decision to do business with you (repeatable/ referenceable business)

We stand ready to engage, discuss and share experiences and perspectives.

- The Vestigo Team

Porfolio Updates

Proud to Announce Cushion's $12M Series A

We are thrilled to announce Cushion's $12M Series A led by Rose Park Advisors with participation from Vestigo Ventures and others. This round of capital will allow Cushion to grow its talent roster to bolster its already strong growth.

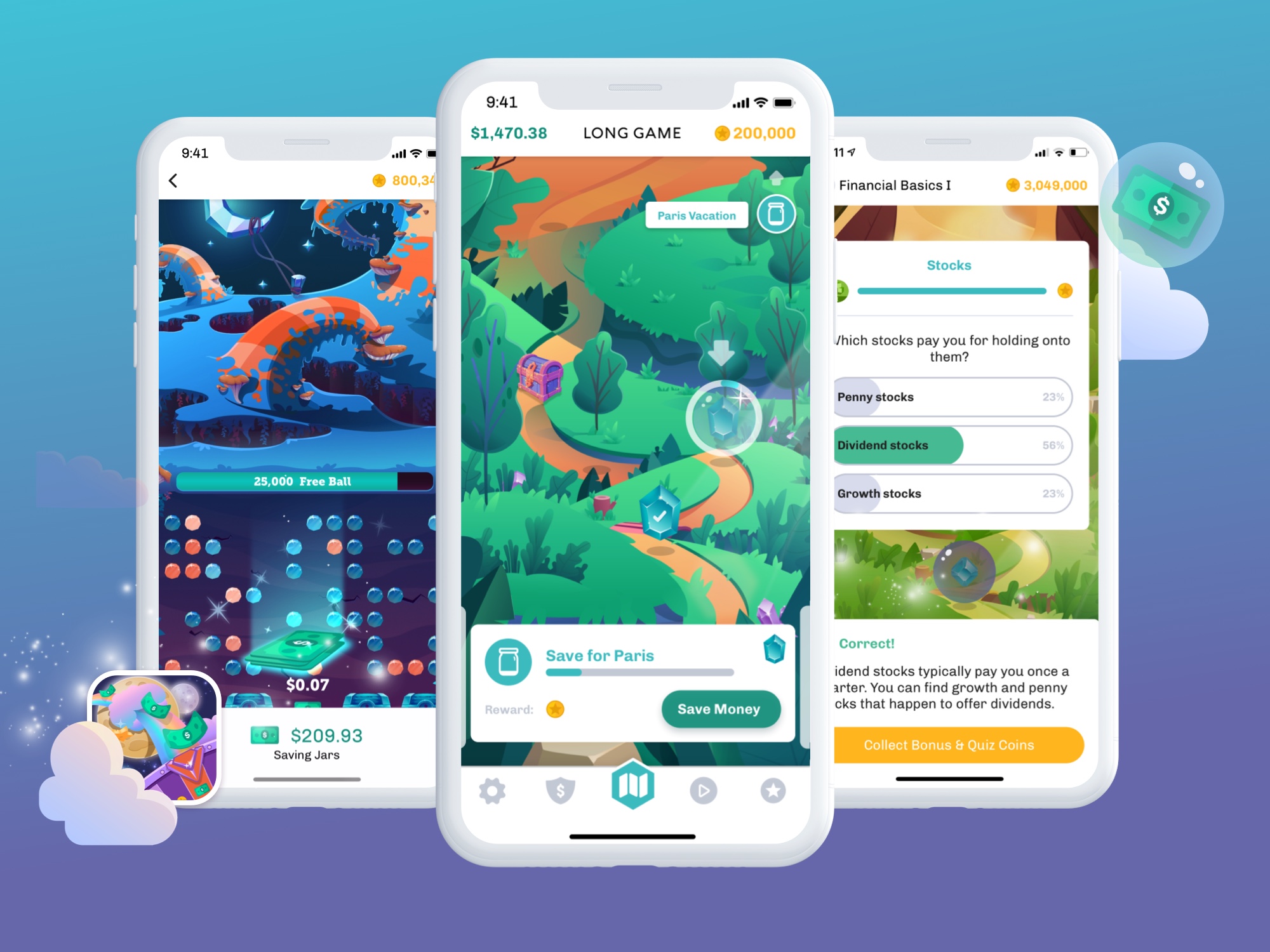

Long Game Acquired by Truist

We are excited to announce that Long Game was acquired by Truist. Truist is the sixth-largest bank in the U.S. and Long Game will help them empower customer acquisition and deepen customer relationships.

Alloy Co-Founder Named Top 100 Women in FinTech

To no surprise, Laura Spiekerman, co-founder and CRO of Alloy was named as one of the top 100 women in FinTech. We could not be more proud investors of such an incredible team and business.

Interesting Reads

Apply to One of Our Portfolio Companies!

Our mailing address is:

Vestigo Ventures

1 Kendall Sq Ste B2101

Cambridge, MA 02139-1588

Add us to your address book

DISCLAIMER: The information presented in this newsletter is intended for general informational purposes only and may not reflect current law or regulations in your jurisdiction. By reading our newsletter, you understand that no information contained herein should be construed as legal, financial, or tax advice from the authors or contributors, nor is it intended to be a substitute for such counsel on any subject matter. No reader of this newsletter should act or refrain from acting based on any information included in, or accessible through, this newsletter without seeking appropriate professional advice on the specific facts and circumstances at issue from a professional licensed in the reader's state, country, or other appropriate licensing jurisdiction. This newsletter and its content should not be considered a solicitation for investment in any way.