Driving Financial Inclusion

Everyone's Welcome

One of Mark's favorite lines is from a university commercial. It goes as follows:

"Equally distributes talent, but it does not equally distribute opportunity."

We have not tried to prove this definitively, but it feels right to us, given our own experiences in life.

Dave grew up in Iran, where his father was an engineer in the oil business before the revolution in the country. Mark grew up in a southern Indiana town (recall the movie Hoosiers) where 65% of his high school class skipped college to join the family farm. These are both very different upbringings, but our diverse backgrounds made us both appreciate that talent is everywhere in the world.

The key for industries and technology breakthroughs is to concentrate that talent in certain areas. A perfect example would be near our offices at One Kendall Square, a highly concentrated area of biotech companies, research facilities, and the venture capital firms it needs to grow and hopefully change the world for the better. The concentration of talent is primarily attributed to the proximity of great universities like MIT or Harvard which, help foster and attract global talent.

Another high-growth industry in the greater Boston area is FinTech. It is not quite the amount of NYC FinTech startups, but the area is beginning to focus on having the talent, the capital, and the support to prosper here. The Commonwealth has created Mass FinTech Hub to foster this growth co-sponsored by many financial services companies and capital providers, including Vestigo Ventures.

Talent does not care about your background. It does not care about your ethnicity, if you are a man, woman, or trying to figure out who you are in the world. It cares about success, defined by your track record, whether through breakthrough ideas or committing yourself to a greater cause.

Our job as a venture firm is to identify the best talent and the most promising. We need to actively monitor and remove any bias to find people like us. I am pleased that our portfolio companies are more diverse and women-led than the venture industry averages by a sizeable margin. However, we must continually be sure we are removing bias in our selection.

We also need to understand that fundamentally a startup can provide greater inclusion of new consumer groups and support underserved businesses. For example, driving down costs for the financial services industry can create a more inclusive offering that financial incumbents could not service.

Technology is a great leveler of bias and the means to support the talent of all types. It's an exciting time to be a venture capitalist investing in FinTech, but with that opportunity comes responsibility.

— Mark & Dave

In our third episode, Frazer chats with Alloy CEO Tommy Nicholas about building a billion-dollar business and some critical lessons he has learned from taking a company from zero to one.

Envisions Interview

It Begins with Please and Doesn't End with Thank You

w/ Edwin Baldry, Co-Founder and CEO at EPBComms

To get yourself a copy, please click here!

Jobble Launches Debit Card to Support the Gig Economy

This month we had the pleasure to speak with Corey Bober, co-founder, and COO of Jobble, to discuss the launch of their debit card. Jobble supports the gig economy that connects over 70 million essential workers seeking jobs, with companies offering flexible work opportunities for those unfamiliar.

We hope you enjoy the Q&A below and if you are interested in learning more about the debit card, please click here.

Why is the release of this debit card a significant milestone for Jobble?

Well, I think there are two answers to this question.

First, from the beginning, Zack and I were on a mission to help support the gig economy and provide the financial solutions they deserved. We began by becoming stellar at giving them access to the income they needed, and now we are making our first steps in providing a suite of financial products, starting with a debit card.

Second, we launched the Jobble debit card in partnership with PNC Bank and Mastercard, which solidified how far Jobble has come since we began this journey.

What are some features of the debit card you are offering?

There are quite a few, but the ones we are most excited about are:

1.) Enables Jobble to pay and fund our gig workers (Jobblers) instantly

2.) Each debit cardholder can create a personalized tax savings goal to estimate how much they should be saving for taxes

3.) The Mastercard partnership provides a rebate program on everyday activities, which is generally reserved for credit cards only

Why haven't current financial products worked for gig workers?

The big issue we have seen is that most financial products are not very customizable, and one thing we have learned is that gig workers need financial solutions tailored to their needs. Therefore, we are filling that gap by giving them a debit card tailored for them, and we hope it will drive a much more inclusive future across the workforce.

How does the debit card tie into the overall vision for Jobble?

As we touched on earlier, we see the debit card as a first step into our overarching mission to become the financial platform for gig workers. In the future, we would love to incorporate various financial products, such as savings, investing, and much more. The gig economy has proven to be essential for many of the services we enjoy today, and we want to be the company that ensures they are supported properly.

Portfolio Updates

ForMotiv Named to Top 100 Most Innovative InsurTechs

Our newest investment, ForMotiv, continues to see great traction after being named a top 100 insurtech. At Vestigo, we continue to be impressed by the team and look forward to their continued success.

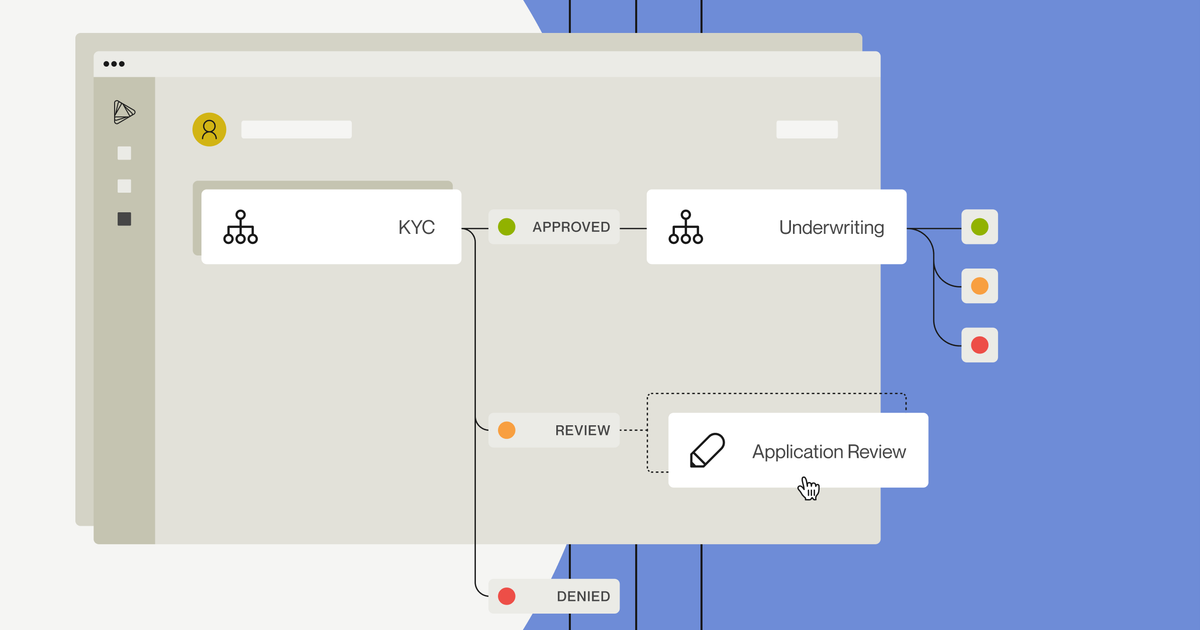

Alloy Launches New Credit Underwriting Product

Alloy continues to expand its platform to offer a credit underwriting solution to help financial institutions make faster and smarter credit decisions while reducing risk for their businesses.

Roots With Launch New SaaS Product in 2022: Iris

We are incredibly excited to see Roots automation launch its newest SaaS product called Iris. Iris is a niche data extraction platform focused on pulling information from medical claim forms using advanced machine learning and specialized OCR.

.png)

Interesting Reads

Apply to One of Our Portfolio Companies!

Our mailing address is:

Vestigo Ventures

1 Kendall Sq Ste B2101

Cambridge, MA 02139-1588

Add us to your address book

DISCLAIMER: The information presented in this newsletter is intended for general informational purposes only and may not reflect current law or regulations in your jurisdiction. By reading our newsletter, you understand that no information contained herein should be construed as legal, financial, or tax advice from the authors or contributors, nor is it intended to be a substitute for such counsel on any subject matter. No reader of this newsletter should act or refrain from acting based on any information included in, or accessible through, this newsletter without seeking appropriate professional advice on the specific facts and circumstances at issue from a professional licensed in the reader's state, country, or other appropriate licensing jurisdiction. This newsletter and its content should not be considered a solicitation for investment in any way.