Sticking to the Fundamentals

Fundamentals are Fundamental

We are often asked about achieving business success. At Vestigo Ventures, our task is to invest in great entrepreneurs and assist them in their journey to success. We focus on three things for them:

- Building a Culture: A company must have clear values for your team and clients who will use your service/software.

- Building Product Market Fit: What you have on offer may or may not be what the market demands. Finding this out quickly by getting honest feedback and iterating is critical to achieving success. Fail fast.

- Finding Product Market Price: Often overlooked by many, it is critical to experiment with price. Many times the solution on offer is new to the world. Do you have some reference for pricing, like what your client will save or how much more they will grow? It is crucial to find the price elasticity curve. The best way we know is to experiment by displaying the price the team feels is correct. Once sold to the market, try doubling the price on the next sales call, and if that works, double it again on the call after that one. It sounds too simple, but it works.

Turns out success in these three areas creates the opportunity for any startup to be well-positioned for its next round of funding. This is our joint objective with our portfolio companies.

Of course, success is also a function of a favorable market environment for the product/service on offer. So our other evaluation point and advice to those seeking business success is to be sure the business has tailwinds. Is the market growing? Are economic conditions positive or negative? Is your service 10X more productive than what is on offer today? Or are you creating a new category in a part of financial services that is ready for change?

With that all being said, we also must mention that luck can never hurt!

- Mark & Dave

New Portfolio Company

Calculum is a Data-as-a-Service platform leveraging AI and advanced analytics to help medium to large enterprises improve their financial supply chains. Calculum empowers treasury organizations, credit and procurement teams by automatically scanning and analyzing supplier spend files to optimize working capital, generate cash flow, and improve margins, while reducing the risk of financial supply chain disruption. The platform features peer benchmarking to understand business performance in the areas of payment terms, Days Payables Outstanding, Days Sales Outstanding, and the overall Cash Conversion Cycle.

The Vestigo Ventures FinTech Podcast w/ Asiff Hirji

In this episode of the Vestigo Ventures FinTech Podcast, Frazer had the pleasure of hosting Asiff Hirji on the show. Asiff, is a Board Director at Forge and former Executive at Coinbase, a16z, Hewlett Packard, TD Ameritrade, and an advisor to Vestigo Ventures. Frazer and Asiff discuss a range of topics, from rapidly scaling a business, investing in fintech, and the state of DeFi.

AI Is Not Only ChatGPT

Since the launch of Chat-GPT, all the buzz around AI/ML has been focused on all the various use cases of large language models and text-focused generative AI solutions (i.e., Chat-GPT). However, we believe that it is critical for all of us to understand that AI/ML has very broad use cases beyond just text generation. For example, we were early investors in Alloy and have seen how critical AI/ML can be for fraud prevention and regulatory compliance for fintech or large financial services companies.

With all that being said, we could not be happier to have Rashveena Rajaram join the Vestigo Ventures team for a semester while she completes her MBA at Harvard Business School and share her thoughts on the applications of AI/ML in fraud prevention. Find the full article below!

- Team Vestigo

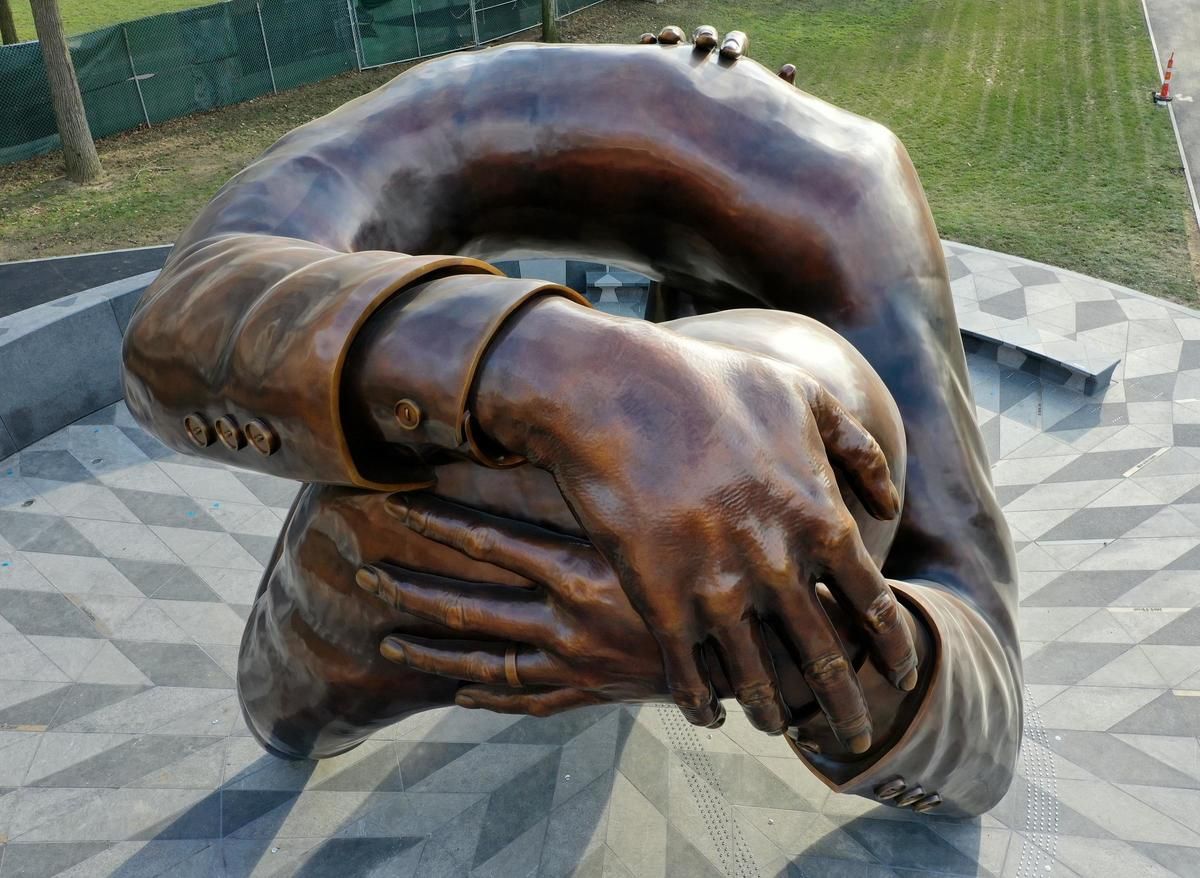

Embrace All

With it being Black History Month, we want to take a moment to recognize the connection to our hometown of one of the great equal rights leaders, MLK Jr. In the image above, we show the "The Embrace" memorial, which is the new tribute to him and his wife Coretta and their meeting at Boston University.

This connection to colleges is where opportunity is open to all and is part of what we stand for at Vestigo Ventures. We strive to find the best entrepreneurs regardless of their backgrounds and support their endeavors to create businesses that will change the world.

- Team Vestigo

Portfolio Updates

Alloy Launches in the UK

We are excited to see Alloy make it's way across the pond to launch in the UK to help fintech's and financial services companies fight fraud.

Roots Automation Bolsters Digital Claims Assistant

Roots has made its Digital Claims Assistant even smarter! Recently, Roots has augmented its digital coworker to have NLP capabilities. This new addition will allow Roots to solve an ~$67B claims leakage problem for insurers, annually.

ForMotiv "Wows" InsurTech Hartford

Huge congratulations to the ForMotiv team! We could not be more proud investors as ForMotiv wins four different awards at the recent InsurTech Hartford Conference.

Interesting Reads

Apply to One of Our Portfolio Companies!

Our mailing address is:

Vestigo Ventures

1 Kendall Sq Ste B2101

Cambridge, MA 02139-1588

Add us to your address book

DISCLAIMER: The information presented in this newsletter is intended for general informational purposes only and may not reflect current law or regulations in your jurisdiction. By reading our newsletter, you understand that no information contained herein should be construed as legal, financial, or tax advice from the authors or contributors, nor is it intended to be a substitute for such counsel on any subject matter. No reader of this newsletter should act or refrain from acting based on any information included in, or accessible through, this newsletter without seeking appropriate professional advice on the specific facts and circumstances at issue from a professional licensed in the reader's state, country, or other appropriate licensing jurisdiction. This newsletter and its content should not be considered a solicitation for investment in any way.