Fundamentals in New Frontiers

Basics Matter

We continue to deploy capital from our Limited Partners into promising companies that are changing financial services. We have made serious progress and have drawn down a material percentage of capital for Fund I. We are a bit ahead of where we thought we would be by spring of 2019. XPLR, our automated company discovery tool, is part of the reason for this advance.

We follow the fundamentals in the process of investing: What do we think of the team that founded the company? How big is the total addressable market?What do we think of the tech stack? It takes discipline to get the basics right, but picking winners is a lot easier when you do.

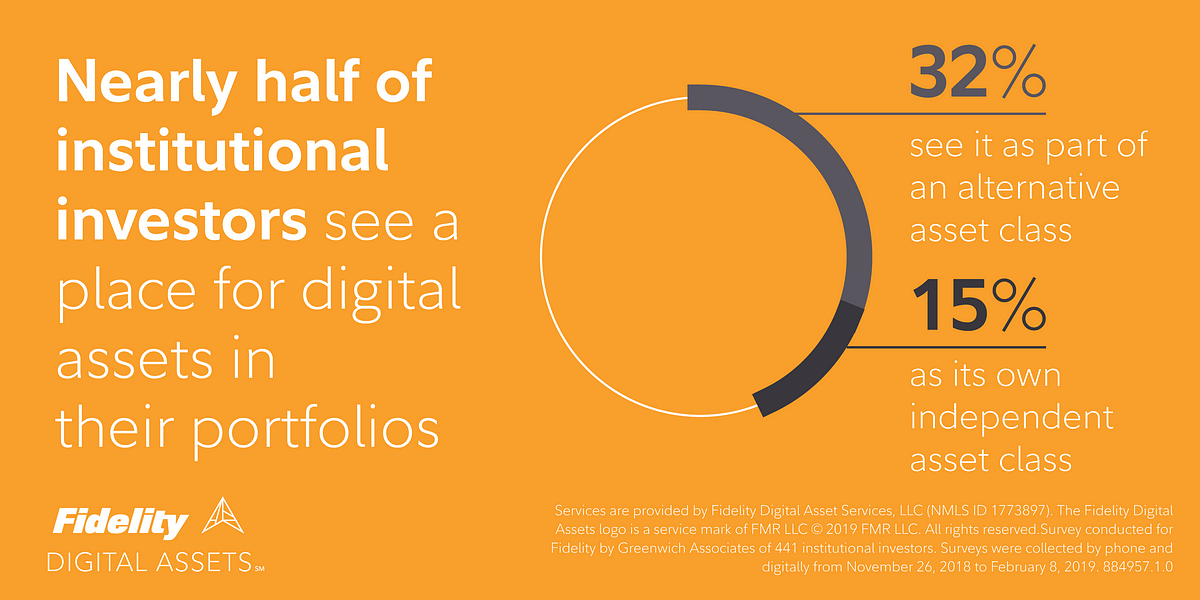

Fundamentals are top of mind as we think about our exposure to crypto assets. Our thesis for Fund I is that a tremendous amount of value will be unlocked over the life of the fund. The pace and form of this technological transformation are less clear. It is obvious that crypto already matters to both institutional and retail investors. Check out the article reviewing Fidelity’s survey of institutional investors concerning crypto investing.

We have focused on foundational companies in the space leading us to three firms: Digital Assets Data, FRST and ZenLedger. Each has done well in their first years of operation. Their leadership provides lessons in readiness and pivoting the business where needed in a new market.

—Mark & Dave

Envisions Interview

Fundamentals in New Frontiers

w/ Ian Sheridan, Managing Director at Vestigo Ventures

Winter Is Leaving...Cryptoros

Borrowing a catchphrase from Game of Thrones is always popular for a blog post but is particularly helpful when writing about the crypto winter we have enjoyed for about a year. Our portfolio companies have used the adverse market conditions to opportunistically add technical talent in a highly competitive job market.

We continue to be believers in the power of alternative asset classes and stores of value. Crypto is an ideal example of both. It shares many characteristics with other tradable currencies, which is why crypto desks are populated with FX traders, except it is not issued by a government. It also digitizes value in a convenient and easily transferable way for investors. It matters because it is a truly decentralized way to transfer value to others and remove friction costs.

It is quite easy to imagine digitization and fractionalization of ownership of assets of all types. ETF’s removed incredible amounts of costs from mutual fund structures which has lead to their popularity. I believe the next phase is to rollout digital assets representing ownership in stocks, bonds and all asset types. While there is still a great deal to do in regulatory oversight and rule making, we will see this happen quickly once ETF’s of crypto assets are allowed.

This matters because of the same cost characteristics of digitization of a currency. It removes the need for cost related to trust verification by building the trust in the asset-blockchain. This cost savings accrues to the savers who now pay them as part of their investing process.

None of this will happen overnight but does represent the march to decentralization of assets and better outcomes to investors to put more of their investment money to work at lower costs. You can practically feel the frost of crypto winter melting!

—Mark Casady, General Partner

Portfolio Updates

Big Raise for Digital Assets Data

Digital Assets Data has been receiving some well-deserved press coverage on their substantial $6M capital raise and the addition of Ryan Alfred as company president. As investors, we are excited to see Mike Alfred and his brother Ryan working together again full-time. The two leaders' complimentary skill sets were instrumental to the success of their previous venture, BrightScope.

Cushion in TechCrunch

Vestigo is a proud investor in Cushion. The platform has already put over $1M back into the pockets of its users and will continue to find other ways to improve personal finance with trueautomation. Cushion has built the kind of bleeding edge technology that gets us excited about the FinTech revolution.

Let us know how much money Cushion has gotten back for you at Envision@vestigoventures.com. If you still haven't tried it out, head to Cushion's website and see what Fee Fighter can do!

Micronotes Lands Major Partnership

We are pleased to report that Micronotes will be teaming up with Kony, Inc. to offer their industry leading AI marketing automation product for digital banking to customers on Kony's DBX platform.

Interesting Reads

Apply to One of Our Portfolio Companies!

Our mailing address is:

Vestigo Ventures

1 Kendall Sq Ste B2101

Cambridge, MA 02139-1588

Add us to your address book

DISCLAIMER: The information presented in this newsletter is intended for general informational purposes only and may not reflect current law or regulations in your jurisdiction. By reading our newsletter, you understand that no information contained herein should be construed as legal, financial, or tax advice from the authors or contributors, nor is it intended to be a substitute for such counsel on any subject matter. No reader of this newsletter should act or refrain from acting based on any information included in, or accessible through, this newsletter without seeking appropriate professional advice on the specific facts and circumstances at issue from a professional licensed in the reader's state, country, or other appropriate licensing jurisdiction. This newsletter and its content should not be considered a solicitation for investment in any way.