Looking Forward: What is Ahead for FinTech?

Time to Reflect

History has always been a keen interest for us. There are countless lessons to draw from what others did in the face of uncertainty or changing of values. Recently, the US feels as though it is in a place of changing values or, more accurately, clashing values.

We owe it to history to be clear on what is acceptable in disagreement and what crosses the line to threaten our institutions and society. The recent protests in Washington DC are an example of unacceptable disagreement.

The leaders in this country must be the steadfast ones and bring the country together through discussion rather than attacking one another. Therefore, we must be clear that what has happened in Washington DC is unacceptable and warn future leaders about the institutional threats to our democracy.

As a firm, we try to stay apolitical; however, these recent events are unacceptable and crossed a line that threatens our society. Lastly, by the time you read this, our elected officials' choices will have been made, but our belief is we need to defend American democracy vigorously.

— Vestigo Ventures Team

Envisions Interview

Looking Forward

w/ Chaz Perera, CEO and Co-Founder at Roots Automation

FinTech Themes for 2021

As I mentioned in our January 2020 newsletter, making predictions often result in disappointing or incorrect predictions. Therefore, I believe it would be much more interesting to discuss key trends and themes in the FinTech sector that will affect Vestigo and our portfolio companies.

- Public Markets Appetite for FinTechs - The recent pandemic shook the world and essentially forced a move to adapt to a completely new environment, especially for the financial services' incumbents. There has been a trend in larger firms looking to outsource portions of their business to adapt to this new environment. This has created a very opportunistic environment for us at Vestigo.

- The Move to Digital - Incumbents moving to a digital framework is clearly a theme here to stay. Working from home further enforces the growth in areas such as automation and cybersecurity to name a few. Further, we expect that this will continue even for the foreseeable future. This will be a strong catalyst for our SaaS companies in our portfolio.

- Explosive Growth in Money Supply - The government printing more money has brought about robust markets and increased interest in crypto (especially Bitcoin). We have seen large names moving into this market, such as Mass Mutual investing $100 million in Bitcoin late last year.

- Challenger Banks - Many challenger banks are maturing and displaying the impact of their business models. Even in an exceptionally low-interest-rate environment, they have adapted by adding subscription fees to make up the revenue gap.

— Mark Casady

Interview with Vault CEO, Romy Parzick

This month, Mike Nugent at Vestigo Ventures interviewed the CEO of Vault, Romy Parzick, to discuss the recent stimulus bill that will allow employers payments towards their employee's student loans to be tax-advantaged and any new events in the student loans space. More details on the stimulus bill can be found in this Forbes article here.

Below will be the interview, and we hope that you enjoy its insights!

What does Vault do?

Vault is an Austin-based startup and a leader in the student loan benefits technology space. Vault’s software allows employers to make one-time or ongoing, tax-advantaged contributions to employees’ student loan balances and helps employees pay down loans faster by usingVault’s optimization tools, enrolling in repayment programs receiving free 1:1 advising from student loan experts.

How does the stimulus bill affect Vault?

This is really positive news for us. It means that for the next 5 years (at least), employer payments towards their employees' student loans (up to $5,250 per year) will be tax-advantaged! The CARES act put this in place for only 2020, and this new stimulus bill extends that coverage for 5 years.

Can you share any COVID + student loan assistance wins?

Healthcare is one of our strongest verticals, including hospitals and hospital systems. These companies come to us looking for help to attract and retain nurses, the vast majority of which are carrying student loan debt. We have seen great success with our clients, some reporting up to a 50% increase in bedside nurses' retention with the Vault Pay program vs. those without it. During the pandemic, especially, this has been an important tool for these HR departments.

What's New in the Student Loan Benefits space?

The most exciting news of 2021 so far is policy news! The most recent coronavirus relief bill has extended employers' ability to make payroll tax-free student loan contributions of up to $5,250 per employee through December 31, 2025. This five-year extension via the stimulus bill is an indication to many experts that this provision will become permanent.

According to the 2019 Society for Human Resource Management (SHRM) Employee Benefits report, 56% of employers offer tuition assistance, but only 8% currently offer student loan assistance. With the new student loan employer contribution tax treatment extended for the next five years and likely to be made permanent, we expect to see many more companies adding student loan benefits like those provided by Vault to their benefits stack.

Tell us something unique about Vault?

Vault is women-led and women-run. Our CEO, COO, and head of product are women (and moms)! Our broader team is majority female. We believe our team composition gives us a distinct advantage as a fintech to "think differently" as we break out of the male-dominated mold.

We hope that you enjoyed reading through some of the insights from Vault's CEO and learning about the incredible work they are doing in the student loan space. To learn more about the company, please check out Vault here.

Portfolio Updates

Jobble Releases Debit Card Tailored to Gig Workers

Jobble finalized a strategic partnership with Mastercard and an industry-leading bank to offer unbanked or underbanked users access to banking solutions tailored to gig workers. Jobble plans to formally announce and begin issuing the card by the end of the quarter.

Vault Benefits from Tax Changes in CARES Act

In short, for the next 5 years (at least) employer payments towards their employees' student loans will be tax-advantaged. Therefore, Vault may see increased demand for their student loan benefits platform. More information on this Forbes article.

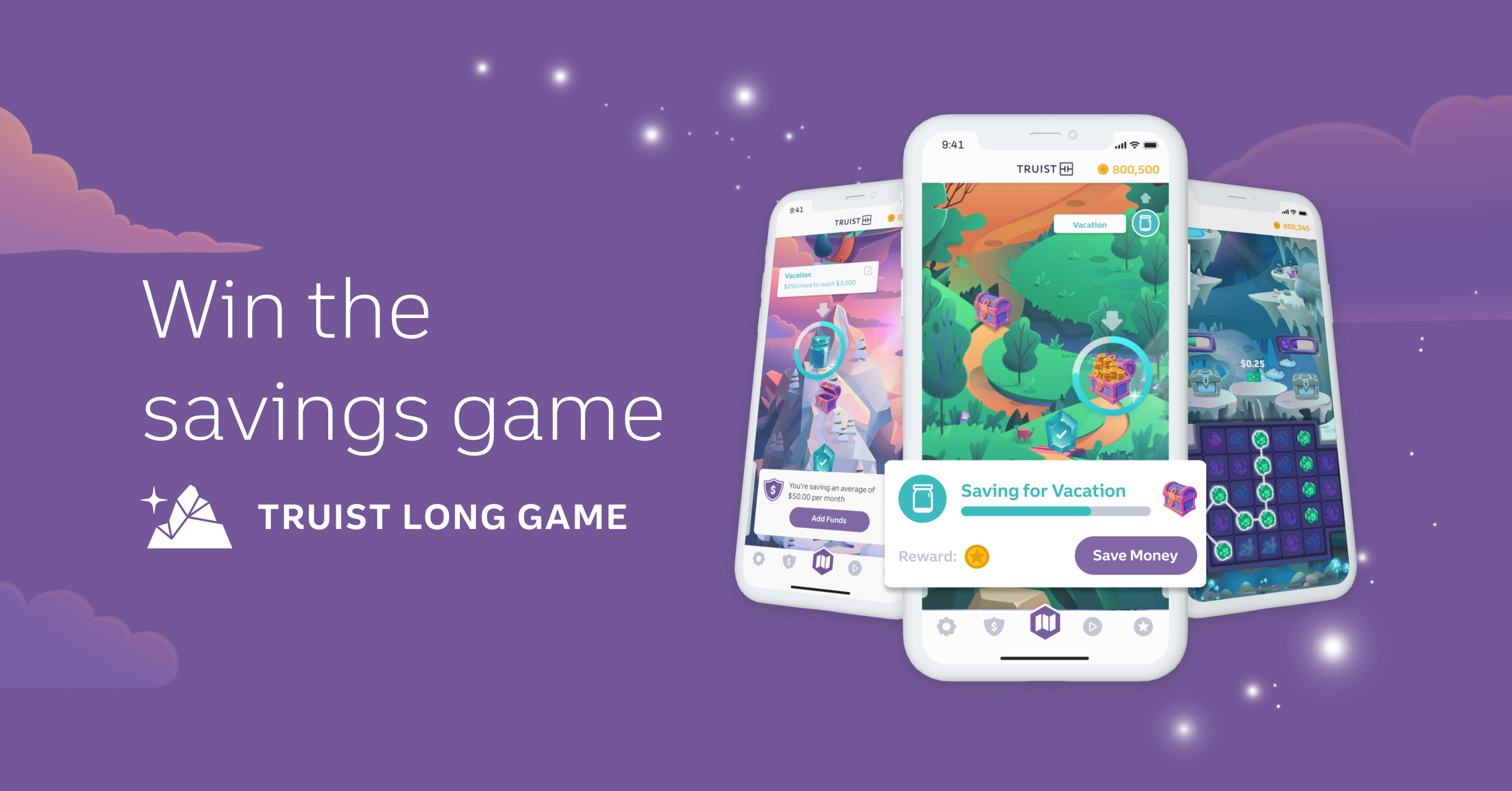

Long Game Pivots from B2C to B2B

Long Game recently shifted its business focus to B2B, where they will transform the way customers engage with banks, leveraging mobile gaming's popularity. Further, Long Game does not need any technical lift from the banks and layers on existing infrastructure to increase consumer savings (20% More!).

Interesting Reads

Apply to One of Our Portfolio Companies!

Our mailing address is:

Vestigo Ventures

1 Kendall Sq Ste B2101

Cambridge, MA 02139-1588

Add us to your address book

DISCLAIMER: The information presented in this newsletter is intended for general informational purposes only and may not reflect current law or regulations in your jurisdiction. By reading our newsletter, you understand that no information contained herein should be construed as legal, financial, or tax advice from the authors or contributors, nor is it intended to be a substitute for such counsel on any subject matter. No reader of this newsletter should act or refrain from acting based on any information included in, or accessible through, this newsletter without seeking appropriate professional advice on the specific facts and circumstances at issue from a professional licensed in the reader's state, country, or other appropriate licensing jurisdiction. This newsletter and its content should not be considered a solicitation for investment in any way.